In business, while calculating the economic profit, we have a factor that we call implicit costs. These implicit costs are the profits that the individual or group of investors enjoys on choosing one option over another. These are the opportunity costs. They do not appear on the financial statement of any business. Managers solely take into account an economically profitable decision when there are many options. Opportunity costs arise mostly from bottleneck situations. Since, in terms of accounting, they are practically non-existent, one can easily miss them out. So, one needs to be extra cautious. Therefore, opportunity costs enable better decision-making in business. This is because the investor learns to increase profit by selecting the path which allows minimum investment.

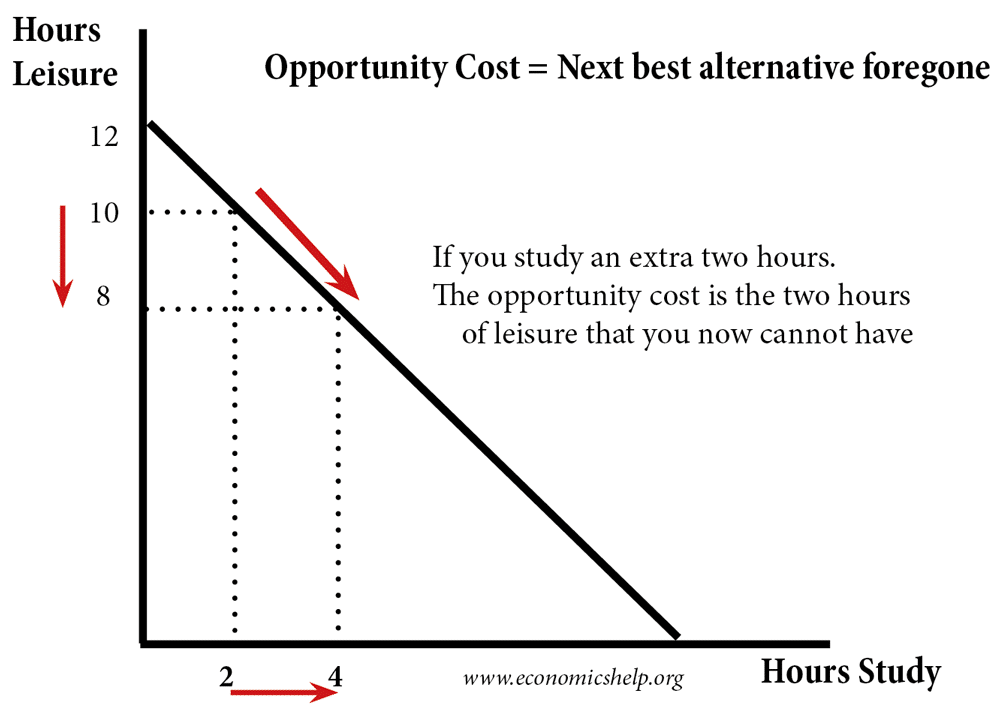

So, mathematically, the opportunity costs help an investor decide what to stick to which would make him lose the gains or loss of a different option. It acts as a scale as you can find the results of various options and then judge the profit. We often get swayed by one decision without considering the cons they might bring with it. This is applicable for our decisions in everyday lives too, like choosing to take a year gap in school. Opportunity costs, hence, are very useful because they make you realize what you are losing in the process and whether they are worth it.

What is the opportunity cost definition?

In simple words, one can define opportunity cost as the alternatives that one loses when choosing a different alternative. So, it provides you with a balance scale. You choose one option and measure its gain or loss. Now, you choose a different option and do the same. You do this for as many options available and then choose the one which is the most profitable to you. Therefore, in simple terms, opportunity costs are all that you need to give up to get something else.

What is the opportunity cost definition in economics?

In the study of microeconomics, economists have defined the opportunity cost of any activity as the “loss of value or benefit. It would be incurred (the cost) by engaging in that activity, relative to engaging in an alternative activity offering a higher return in value or benefit.”

/opportunity-cost-definition-393313-FINAL-06131b369c8e4acdbc81d996f20cf4cb.png)

What is the opportunity cost theory?

What do the opportunity costs represent?

In microeconomics, opportunity costs establish the relationship between two key economic concepts of scarcity and choice. So, the main objective of opportunity cost is efficiency. Efficiency, in economics, means the maximum utilization of scarce resources. Opportunity costs are implicit, as we already know. However, they take into account the explicit costs too. As we have already seen, it is more than just a monetary benefit. It also includes an overall utility with an economic profit to an individual or group.

For example, suppose you think of going for a walk in the evening. This has no monetary implications. However, tomorrow you have an exam and you could have spent the evening studying at home. So, the opportunity cost of the evening walk would be the chapters you are missing out on. However, there are other implications too. It might be that you needed a break badly to oust the stress before the exam.

How can we know about all the possible combinations?

The maximum number of combinations of the different factors of production appear on a production possibility frontier. For example, let us place the number of services on the x-axis and the opportunity costs on the y-axis. So, now if, let us say, the number of services increases by 5 units, the opportunity cost must decrease by 5 units. This is because the total area under the axes must always be the same. So, the opportunity cost in the increase of production would be the loss of those 5 goods.

What is the defining factor of opportunity costs?

Scarcity is its defining factor. This is because no matter where and how they occur, if there was no scarcity, they would not exist. When there is no scarcity, no needs of an individual remain unsatisfied. So, he does not need the choice that is key to these costs in the first place. The very question of choice arises when there is a scarcity of resources and one has to use them judiciously. One has to make a decision because when resources are scarce, using one prevents one from using another in a different way.

What is sacrifice?

When the individual or the investor makes one decision, he does away with the opportunities that the next best option provides. This measurement in the opportunity costs is what economists call “sacrifice”. So, it means to forego the utilities which an equally good option might have given if one had not selected the option at hand currently. Most of the decisions entail a sacrifice. This is because if there is no sacrifice with a particular decision, it means that it is a cost-free decision. Cost-free decisions have no or zero opportunity cost. So, this is quite impossible because decisions can hardly be absolutely profitable. Hence, one only observes again and again how important the analysis of opportunity costs is for an investor to choose the most profitable project. This, furthermore, allows optimal allocation of limited and scarce resources to maximize efficiency.

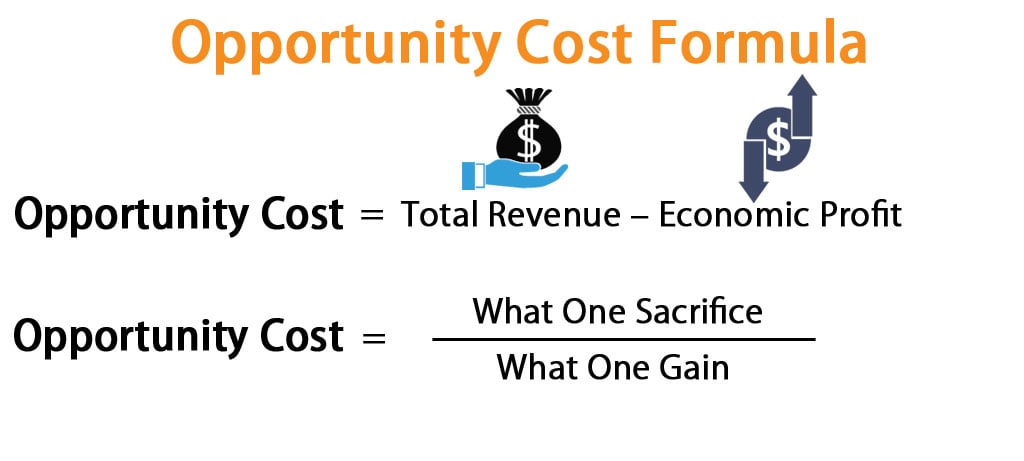

What is the opportunity cost formula?

To calculate the opportunity cost of any decision or investment, we do it in terms of the return or profit to that investment.

So, opportunity cost = Return on Most Profitable Investment Choice – Return on Investment Chosen to Pursue.

However, the returns to the investments are generally stationary in the case of business transactions. The investor is functionally guaranteed to get the payment. For example, in the case of a U.S treasury bond that one intends to hold till it reaches maturity. So, one has to found the calculations on the returns that one cannot foresee now. For instance, the stock market currently has a 7% annual return. However, this does not assure that if you invest, you will also get a 7% return this year.

Give opportunity cost example

Suppose, one fine morning the notary calls you up and tells you that a rich, distant relative has given you $1,00,000. Now, you are obviously overjoyed. As a result, you quickly make a decision on what you want to do with the money. You decide that at first, you will invest the entire sum. After one year, you will use the returns to the investments to buy a house. So, you call up your financial advisor. He places before you a variety of options regarding how you should invest the money. Now, let us consider that all the options have the same medium-high risk profile. This is because you are voluntarily taking up the risk.

So now, you have quite a few options like-

| Investment | Supposed rate of return |

| Low-grade corporate bonds | 10% |

| Software company stock | 8% |

| Shares in a steel company | 6% |

Now, you are personally inclined to invest in the software company. You do this because you trust the company and feel you should support the sustainability methods that they are endorsing. However, you cannot forget that the bonds are more attractive as they give an 8% return. Moreover, bonds mean you will get a certain amount at the end of one year. This would prevent you from looking up the stock quotes every single day.

So, now you need to find out two things-

- the opportunity cost as a percentage if you choose to invest in the stocks of the software company.

- The value of the opportunity cost in dollars.

Solution

The next best option for investment will be the low-grade corporate bonds as they give a higher rate of return than the software company which is your choice.

- Opportunity Cost = Return on Most Profitable Investment Choice – Return on Investment Chosen to Pursue

- Therefore, Opportunity Cost = 10% – 8% = 2%

- So, the opportunity cost of choosing the software company stocks as the channel of investment is 2%.

- To find the opportunity cost in dollars, we need to multiply the opportunity cost percentage with the total money that you initially invested.

Therefore, opportunity cost ($)= 2% * $1,00,000 = $2,000.

So, the final answer is $2,000.